SUSTAINABLE FINANCE

With sustainable financing serving as a powerful enabler in building a greener and better future, mitigating and adapting to climate risks presents huge investment opportunities. This is evident from the establishment of the UN PRI, an investor initiative in partnership with UNEP Finance Initiative and UNGC, which the Company became a signatory of in September 2021. As at August 2023, the total assets under management of companies that are committed to PRI was more than US$121.3 trillion, signalling an accelerating transition towards sustainable assets.1

In December 2021, the Company rolled out our Sustainable Investment Principles (SIP). This reinforces our commitment in taking proactive steps in assessing potential portfolio risks and opportunities for sustainable investments. The SIP complements our existing ESG policies and guidelines, and is aligned with the Glasgow Climate Pact, UN SDGs, UN PRI, TCFD, UN Environment Programme Finance Initiative (UNEP FI) and other global frameworks.

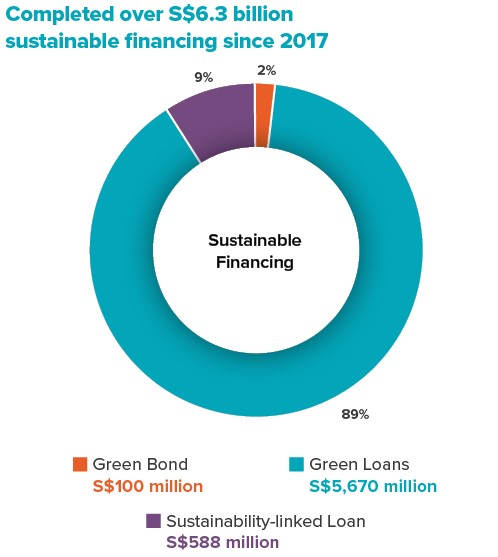

Since the issuance of our first green bond in 2017, the Group has completed over S$6.3 billion of sustainable finance, including various green loans, a green revolving credit facility, and sustainability-linked loans. At the end of 2023, S$4.6 billion of our sustainable finance amassed has been deployed to finance our existing investments and/or assets.

In December 2023, the Company became the first Singapore corporate to secure the OCBC 1.5°C loan, Singapore’s first net-zero-aligned loan for corporates to drive the transition to a low carbon economy. With this new £200 million sustainability-linked loan (approximately S$338.2 million2), the Company marked a new sustainable financing milestone, reflecting our commitment to achieve operational net-zero by 2030 for our new and existing wholly-owned assets and developments under our direct operational and management control, with the entire portfolio achieving operational net-zero by 2050. For this achievement, in March 2024, the Company was awarded Best Sustainability-Linked Loan – Real Estate award at The Asset Triple A Sustainable Finance Awards 2024.

For our successful R&D and pilot of DigiHUB, a digital platform to raise building management efficiency, the Company secured a discount on the SDG Innovation Loan provided by DBS Bank in 2021. The Company became the first Singapore entity to achieve a discount on a sustainability-linked loan through the adoption of an innovative project that supports the UN SDGs on a large-scale basis. In October 2022, we renewed our SDG Innovation Loan, entering its second phase with S$250 million secured.

In April 2021, the Group’s South Beach Consortium secured a 5-year green loan totalling S$1.22 billion – one of Singapore’s largest green loans to date. In August 2021, the Group and our JV partner jointly secured green loans amounting to S$847 million for the financing of two projects that were launched in 2022 – Piccadilly Grand and Copen Grand. As a green developer, the Company is heartened that our strong sustainability track record enables us to tap into the fast-growing sustainable financing pool to benefit our JV projects, sharing a green vision of a low carbon future with our like-minded partners.

Aligned with good practices, our Sustainable Finance Framework has embraced leading global frameworks including the Green Bond Principles, Green Loan Principles and Sustainability Linked Loan Principles. More than just demonstrating the Company’s good governance in sustainable financing, the framework also supports building sustainable and climate-resilient cities and communities. In 2022, the framework was revised from its original version dated 2019, to reflect our developments on sustainability and climate action, as well as to expand on the SDG Innovation Loan concept.

| 1 | UN PRI Annual Report 2023 |

| 2 | Based on an exchange rate of £1 = S$1.6909 |