Energy Reduction and Management Strategy

Electricity constitutes a significant proportion of the Company’s operational expenditure. It impacts the total amount of Scope 2 emissions released through our business activities. We place great emphasis on prioritising cost-effective improvements of our energy performance and reductions in our carbon emissions and energy intensities. In 2014, the Company became the first developer in Singapore to achieve the ISO 50001 energy management system certification for asset management. We continue to set energy reduction targets for our managed buildings in Singapore with regular reviews and implementations of energy management plans.

Energy Reduction Strategy and Initiatives

Since 2004, the Company has retrofitted all our managed buildings by upgrading chiller plants, introducing motion sensors and installing energy-efficient lighting. Barring temporary suspension due to business disruptions in 2020 and 2021 due to COVID-19 pandemic, we resumed the implementation of new energy saving initiatives in 2022. Our cumulative initiatives since 2012 have continued to yield an estimated annual energy savings of around 14.7 million kWh, equivalent to about S$3.5 million annual cost savings. We have also incorporated climate-resilient design and piloted solutions such as sustainable paints, more advanced energy-efficient AHUs with an EC fan, chiller plant optimisation and micro-climate control solution at our managed buildings to reduce heat gain and improve energy efficiency. Furthermore, we have transitioned our chiller plant maintenance agreements to energy performance contracts to maintain energy efficiency in our managed buildings.

| Stage in Project Lifecycle | Key Energy Management Initiatives | Benefits |

| Design | Incorporate passive design strategies that reduce solar heat gain through design of building form, envelope and orientation | Reduce electricity consumption and cooling cost |

| Increase building greenery on roof and facade to reduce urban heat gain | ||

| Increase natural ventilation to improve passive cooling and reduce heat gain | ||

| Maximise natural lighting | Reduce electricity consumption and cost | |

| Use energy-efficient lighting such as LED lighting in all common areas | ||

| Incorporate energy-efficient home appliances in building units | ||

| Incorporate solar panels such as building-integrated photovoltaics (BIPV) systems in common areas, where applicable | Reduce reliance on the grid and lower carbon emissions | |

| Construction | Use electricity directly from the power grid supply to reduce reliance on diesel generators where applicable | Reduce emission levels of carbon, sulphur oxides, nitrogen oxides and particulates |

| Operation of Assets | Identify high energy consumption installations and their respective energy management opportunities, e.g. installation of PV, chiller upgrading and lift modernisation | Reduce electricity consumption and cost |

| Install sub-metering systems to provide data granularity and identify energy management opportunities | Enhance the monitoring and control of building equipment (e.g. heating ventilation and air conditioning, lifts) to reduce energy use | |

| Leverage advanced management systems to enhance building performance, e.g. Energy Management System to optimise chiller efficiency and Building Management System to control key equipment in buildings | ||

| Generate on-site renewable energy, where possible, through the installation of PV and BIPV panels | Reduce reliance on fossil fuel; lower carbon emissions |

Green Lease Partnership Programme

Over the years, we have actively engaged tenants to raise sustainability awareness and promote green practices along our value chain. Since 2014, we have encouraged our tenants to adopt energy conservation measures and continued to maintain a 100% programme participation rate for our retail and office tenants in 2023.

Accelerating Renewable Energy Solutions

The adoption of renewable energy is integral in the design and construction of our projects. We have been exploring more installations of solar panels in our buildings to increase renewable energy. We have progressively participated in the emerging Renewable Energy Certificates (RECs) marketplace since 2017. By procuring locally-sourced RECs, 100% of the electricity consumed by our headquarters’ operations and part of our commercial buildings’ operations in 2023 was attributed to renewable sources. This helped to offset 412 tonnes of carbon emissions, equivalent to powering approximately 242 four-room HDB flats for one year.

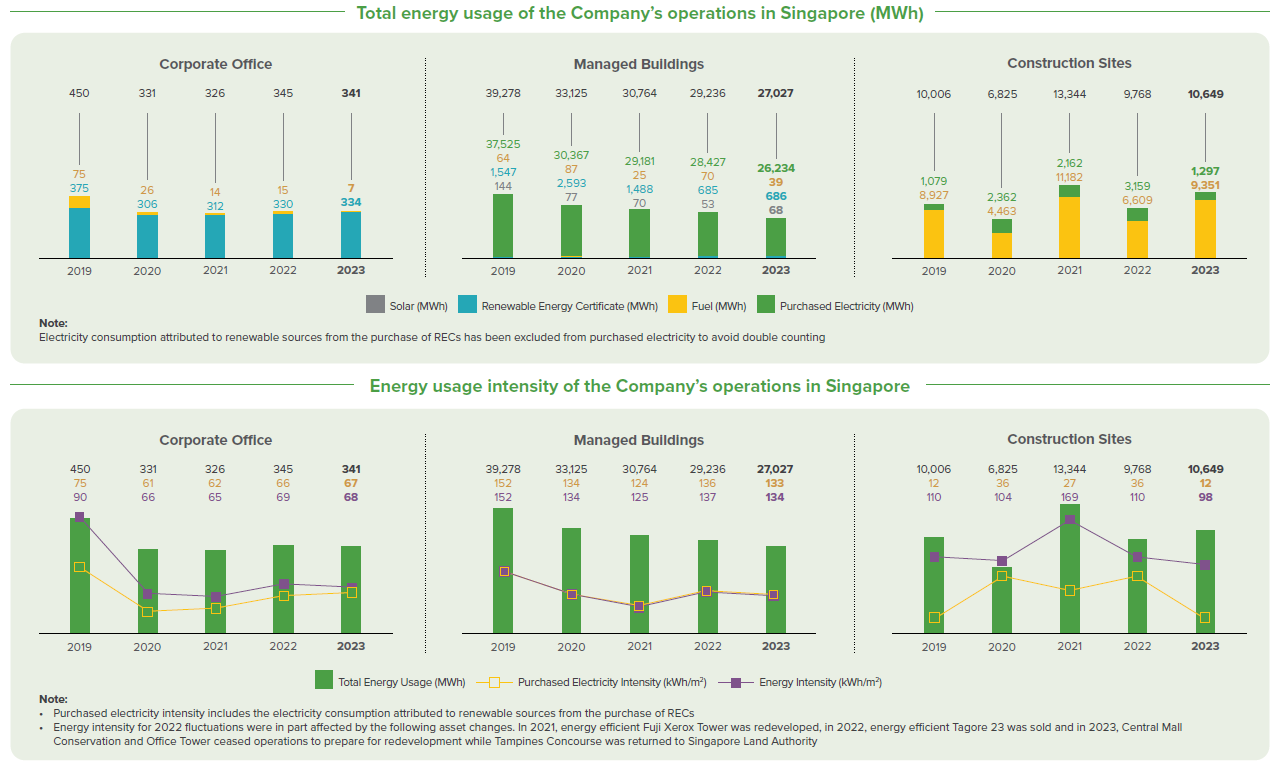

Energy Efficiency and Reduction Performance

Since 2007, the Company has been tracking and reporting our environmental performance against our energy targets under our ISO 14001 and ISO 50001 environmental and energy management systems. We regularly review the energy reduction and efficiency plans for all our properties and introduce initiatives for improvements.

Our 2023 annual interim targets aim to reduce energy use intensity by 21% from 2016 levels for office and industrial buildings, and 27% from 2016 levels for retail buildings. We achieved a lower reduction performance of 20% for energy use intensity because of hot weather and higher traffic that resulted in a higher cooling load in 2023.

We monitor and drive energy efficiency and reduction improvements through target and performance tracking for our development projects. Our current targets are to achieve an energy use intensity of 95 kWh/m2 or lesser by 2030, with an interim target of 105 kWh/m2 or lesser in 2023, for completed projects that have reached TOP status in the reporting year.

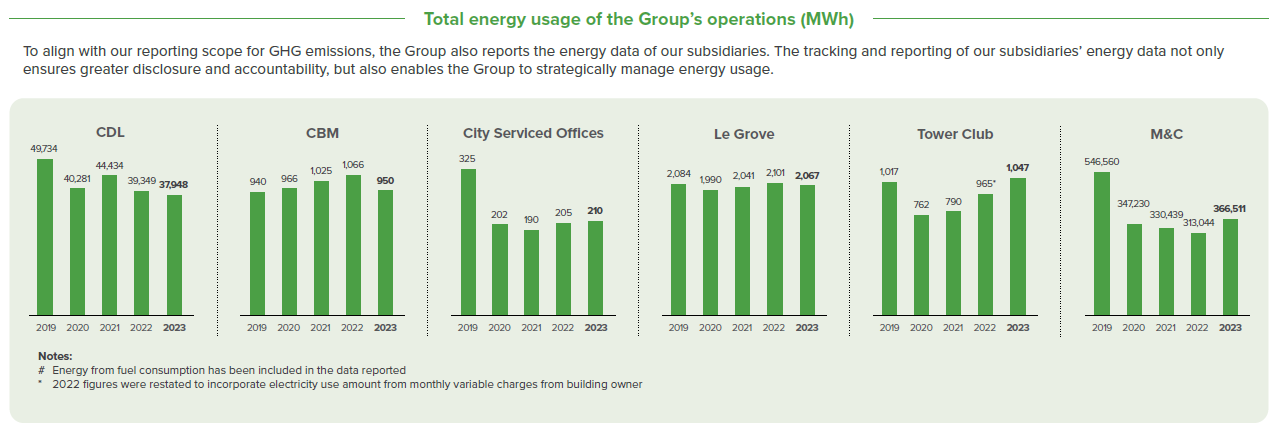

In 2023, the absolute energy targets for corporate office and managed buildings were derived from the targeted energy intensity reductions. Inclusive of the operational performance of our construction sites1, an absolute targeted value of 38,000 MWh (number rounded to nearest ten thousand) or below was obtained. The target was met for the year 2023. Refer to ISR 2024 for specific targets set and performance for the Company’s various operations.

| 1 | Operational performance of construction site are directly added to the absolute target values for corporate office and managed buildings as the set targets for construction are based on completed projects in terms of energy use intensity, while the reported numbers in the graphs are for yearly operational energy usage for construction sites. |