3RD CLIMATE CHANGE SCENARIO ANALYSIS

With progressive adoption of the TCFD Recommendations across financial markets, climate-related scenario analysis is fast becoming a business strategy norm. The climate change scenario analysis, a key recommendation of the TCFD, aids corporates in understanding the strategic implications of climate-related risks and opportunities.

Climate Change Scenario Study: Risks Identification, Categorisation and Mitigation

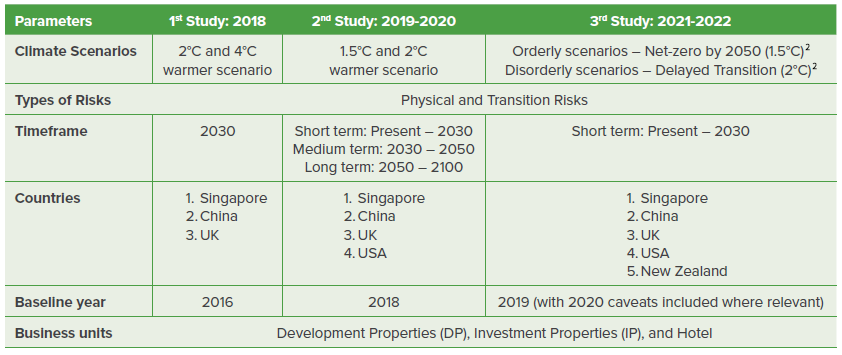

Facilitated by an independent third-party consultant, the Company completed our third climate change scenario study in December 2022 to better understand the short to medium-term financial implications of climate change and COVID-19-related risks trends. Factoring in recent developments and up-to-date literature, the third analysis increased its scope coverage and incorporated methodology and data updates, as well as new risks to be quantified. The study identified, categorised and prioritised climate-related physical and transition risks based on relative magnitude of the expected financial impact of the risk and opportunities it addressed.

The TCFD risk taxonomy was reviewed and assessed for relevance to the financial impact on the Company for each transition and physical risk in both the 1.5°C and 2°C scenarios, and across the five countries.1 Risk mitigation measures were identified and integrated into business operations through the Company’s ERM framework. We manage risks by tracking interim performance against our CDL Future Value 2030 Sustainability Blueprint, refining our environmental management systems and carbon performance metrics, in line with global standards such as the GHG Protocol and ISO 14064.

Risk Management and Strategic Decision-making Process

At the Group level, we adopt an integrated top-down and bottom-up risk review process that enables systematic identification and prioritisation of all material transition and physical risks. The Board, supported by the ARC and other Board committees, assumes responsibility and oversight of key risks to the Group’s business. Relevant and material risk issues are surfaced for information and discussion with the ARC and the Board minimally every quarter. The ARC considers the nature and extent of significant risks which the Group may undertake in achieving our strategic objectives, and guides management in the formulation and implementation of the risk management framework, policies and processes. This ensures that significant risks are effectively identified, evaluated and mitigated, to safeguard shareholders’ interests and the Group’s assets. The ARC also reports to the Board on critical risk issues, material matters, findings and recommendations.

| 1 | Countries under the 3rd climate change study include China, New Zealand, Singapore, UK and USA |

| 2 | Terminologies from Network for Greening the Financial System (NGFS)’s Framework |

Charting the Way Forward for a Net Zero Future

* High Risk: financial impact amounting S$20 million and above

* Moderate Risk: financial impact below S$20 million

Please slide left to view more.

| CDL GET Strategy Alignment | Adaptation and Mitigation Category | Climate Change Risks or Opportunities Covered | Level of Risk6 or Opportunity in 2030 | Description of Potential Financial Impact | Priority Markets |

Growth (Design and Build) |

Sustainable Construction | Green features construction cost premium | Designing and constructing new net zero buildings more cost-effectively | Singapore, China, US and UK | |

| Construction material cost increase (carbon price) | |||||

| Labour cost increase due to heat stress (New) | Improving construction productivity and footprint; reducing outdoor work risk | Singapore, China | |||

| Maintenance (Scope 1-3 GHGs), Waste and Water costs for DP | Singapore, China | ||||

Enhancement (Manage) |

Green Retrofits | Maintenance (Scope 1-3 GHGs), Waste and Water Costs for IP and Hotels | Encouraging waste recycling and reduction | Singapore, US, UK | |

| Energy cooling costs | Improving energy and water efficiency in accordance to latest green building standards | Singapore, China, US and UK | |||

| Potential loss of green rental premium revenue (New) | Meeting increased customer preferences/demand | Singapore, UK | |||

Transformation (Strategic review of portfolio and investments) |

Extreme Events Adaptation and Mitigation | Business damage and loss to due to extreme events | Avoiding or reducing exposure to extreme events risks for new developments | Singapore, UK | |

| Climate-related insurance premium increase (New) | Improving existing developments’ resiliency to extreme events | Singapore, UK, US | |||

| Changing demand patterns | Avoiding stranded assets | Singapore, China, US, UK, and New Zealand |